stock option tax calculator ireland

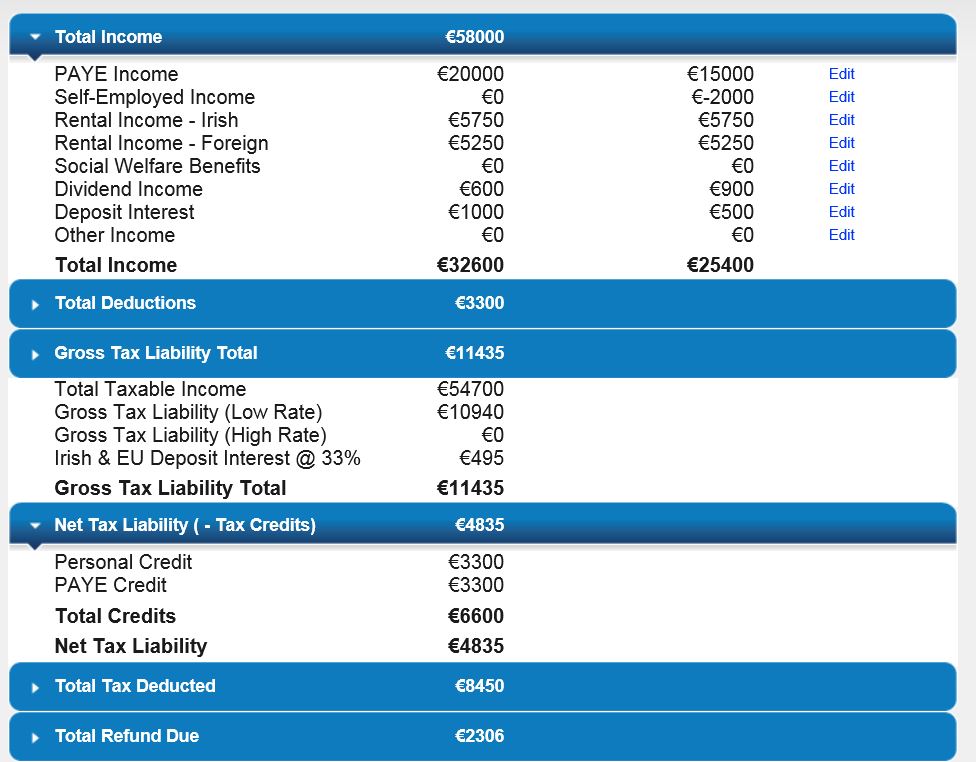

In this example the following rates are used. Calculate Tax Clear Form.

Paylesstax Share Options Rtso1 Tax Calculator Paylesstax

The value of the benefit is the market value of the shares at the date they were awarded.

. Amount you pay when you exercise the option. Any income tax due on the exercise of the option is chargeable under self-assessment. Approved Profit Sharing Schemes allow an employer to give an employee shares in the company up to a maximum value of 12700 per year.

Income Tax rates are currently 20 and 40. Rates can be found on the Fee Schedule. The employer must hold the shares for a period of time called the retention period and you.

The Global Tax Guide explains the taxation of equity awards in 43 countries. You must complete a RTSO1 Form when making your payment. Financing cost charged at overnight market rate.

No responsibility is taken by Deloitte for any errors or for any loss however occasioned to any person by reliance on this calculator. USC is tax payable on an individuals total income. Note - All figures in Euros all figures rounded up to nearest Euro.

We do our best to keep the writing lively. You will only pay tax if the option price is less than the market value of the shares at the grant date. 343 Long Options - Tax at Date of Grant Where a share option is capable of being exercised.

The problem is that there is literally no information in the Internet about how this activity would be taxed in Ireland. Standard rates for USC for 2019 are 05 of the first 12012. The rate for the DEGIRO Trackers and Investment Funds Core selection is based on a Fair Use Policy.

These shares are a benefit in kind BIK. The due date for filing a return is 31 March following the end of the tax year. How to pay.

This gives the total tax bill of 10400. The taxation in Ireland is usually done at the source through a pay-as-you-earn. You also need to deduct any losses.

10 for gains on sales that qualify for Entrepreneur Relief. If you have more than one gain add them together. Interest charges can apply for late payment of tax.

Providing the scheme meets the required conditions you will pay no income tax on shares up to the maximum value. And 8 of any remaining balance. Capital Gains Tax Due Formula Sales Price - Present Value of Total Purchase Price including conveyancing and surveyors fees Present Value of Enhancement Costs Selling Costs 1270 X 33 1270 per person ie 2540 for a married couple where the asset is jointly owned.

On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of. 2022 2021 Income Tax Calculator TaxCalc allows you to estimate your take home pay based on your total pay pension contribution and personal circumstances. Ireland Corporation Tax Calculator 2022.

If yes - enter amount paid by your employer. You might need to use the market value instead of. From 2011 onwards PRSI 4 and the USC 8 charges also apply.

A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company. Companies Irish branches and agencies granting options including an Irish employer where the options are granted by a non resident parent company must complete returns of information Form RSS1 regarding the options. The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland.

A short option no charge to income tax arises on the date that the right is granted. Stock options restricted stock restricted stock units performance shares stock appreciation rights and employee stock purchase plans. 125 for gains from venture capital funds for companies.

You buy back the. Stock options There are a number of issues with the current taxation of stock options. There are other rates for specific types of gains.

With TaxCalc you will be able to see a breakdown of all your deductions from your gross pay and estimate how much a pay increase or deduction is going to impact on your. You purchase 10 Irish shares in January 2022 at a cost of 500 each. The calculator allows quick capital gains tax calculations and more detailed capital gains tax calculations with multiple line items so that you can calculate the total tax due on several.

15 for gains from venture capital funds for individuals and partnerships. The calculator allows corporation tax calculations for multiple scenarios including rates and. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France.

342 Short Options - Tax at Date of Grant Where a share option is not capable of being exercised more than seven years after the date on which it is granted ie. EToro income will also be subject to Universal Social Charge USC. Marginal tax rates currently up to 52 apply on the exercise of share options.

Revenue Online Service ROS myAccount. 2 of the next 7862 2. Example of Reduced Capital Gains Tax on Shares in Ireland.

40 for gains from foreign life policies and foreign investment products. Assuming the 40 tax rate applies the tax on the share options is 8000. Hi everyone Im interested in starting to trade US stock options contracts.

Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. The Ireland Corporation Tax Calculator is designed to allow free online calculations for resident and non-resident companies banks financial institutions and non-operating entities who have accrued income from profits in Ireland. The country profiles are regularly reviewed and updated as needed.

If you owned the asset before 2003 you may claim indexation relief. Therefore employees have to use their salary andor other income or where possible sell sufficient shares in order to fund the taxes arising on exercise. 45 of the next 50672.

Click here for more insights from Deloitte. The 30 day period includes the exercise date. The Revenue website explains how the Capital Gains Tax works 33 for Irish and 40 for foreign properties if I understood correctly.

You must pay RTSO within 30 days of exercising the options. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. Each share has gained 300 You sell 4 shares for 3200 creating a capital gain of 1200 which is below the 1270 exemption from CGT.

You paid 10 per share the exercise price which is reported in box 3 of Form 3921. The tax is due on the difference between the. You can make your payment using.

For more information see here. Send the form to the Collector-Generals Office. Calculate your chargeable gain for the whole tax year.

This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option. In October 2022 they are worth 800 each. You will pay IT Universal Social Charge USC and Pay Related Social Insurance PRSI on the amount of the difference.

How To Calculate Crypto Taxes Koinly

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

What Is The Formula To Calculate Income Tax

Tax Credit Definition How To Claim It

Paylesstax Share Options Rtso1 Tax Calculator Paylesstax

How Is Yield Farming Taxed Koinly

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

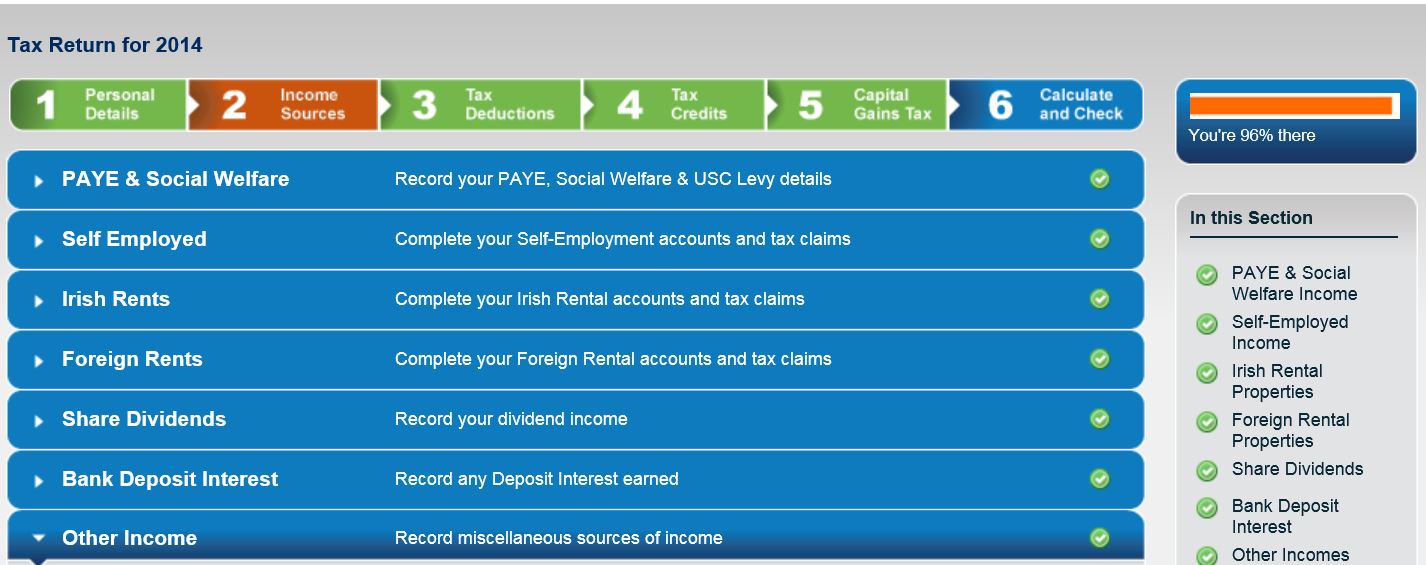

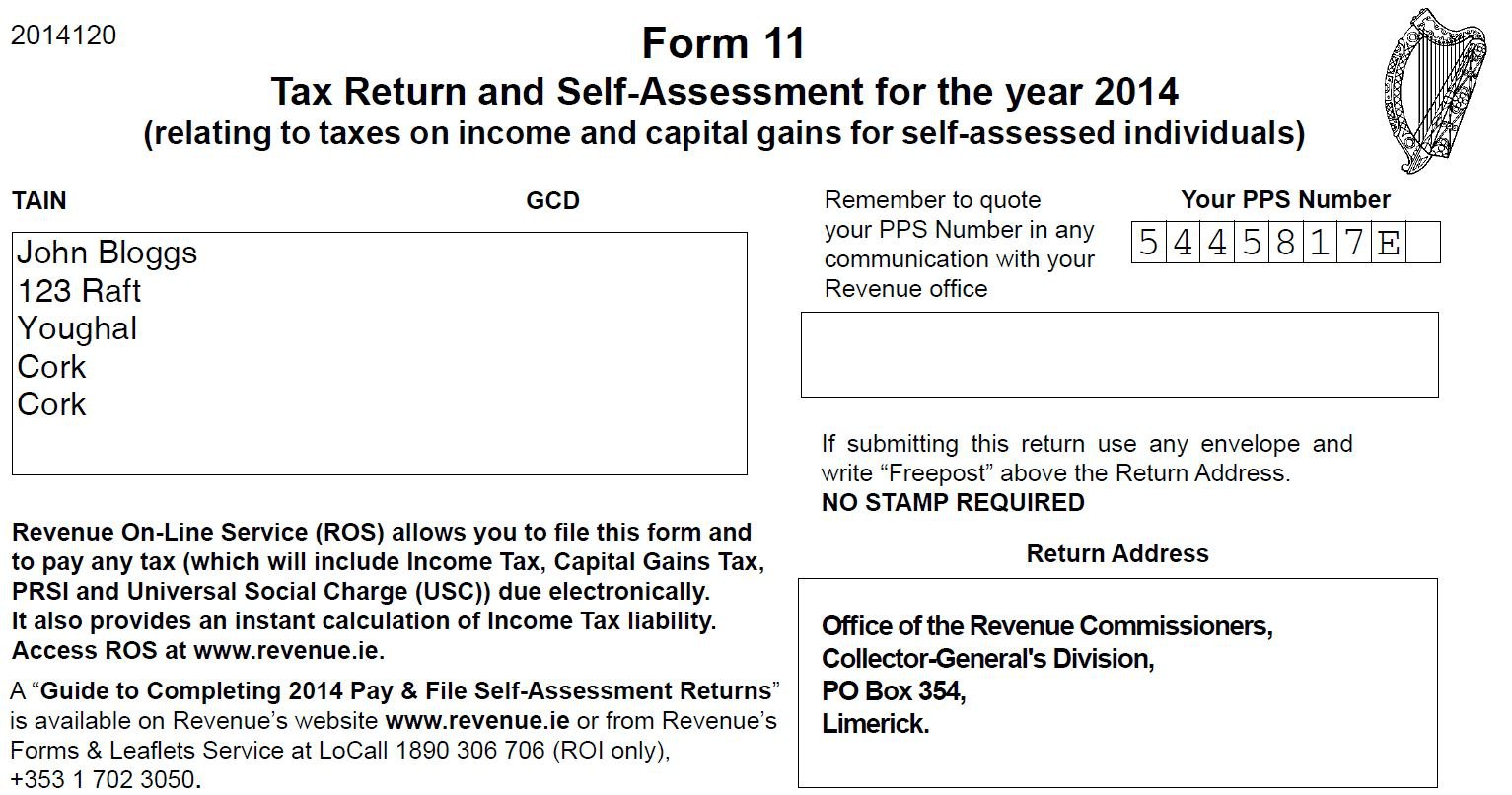

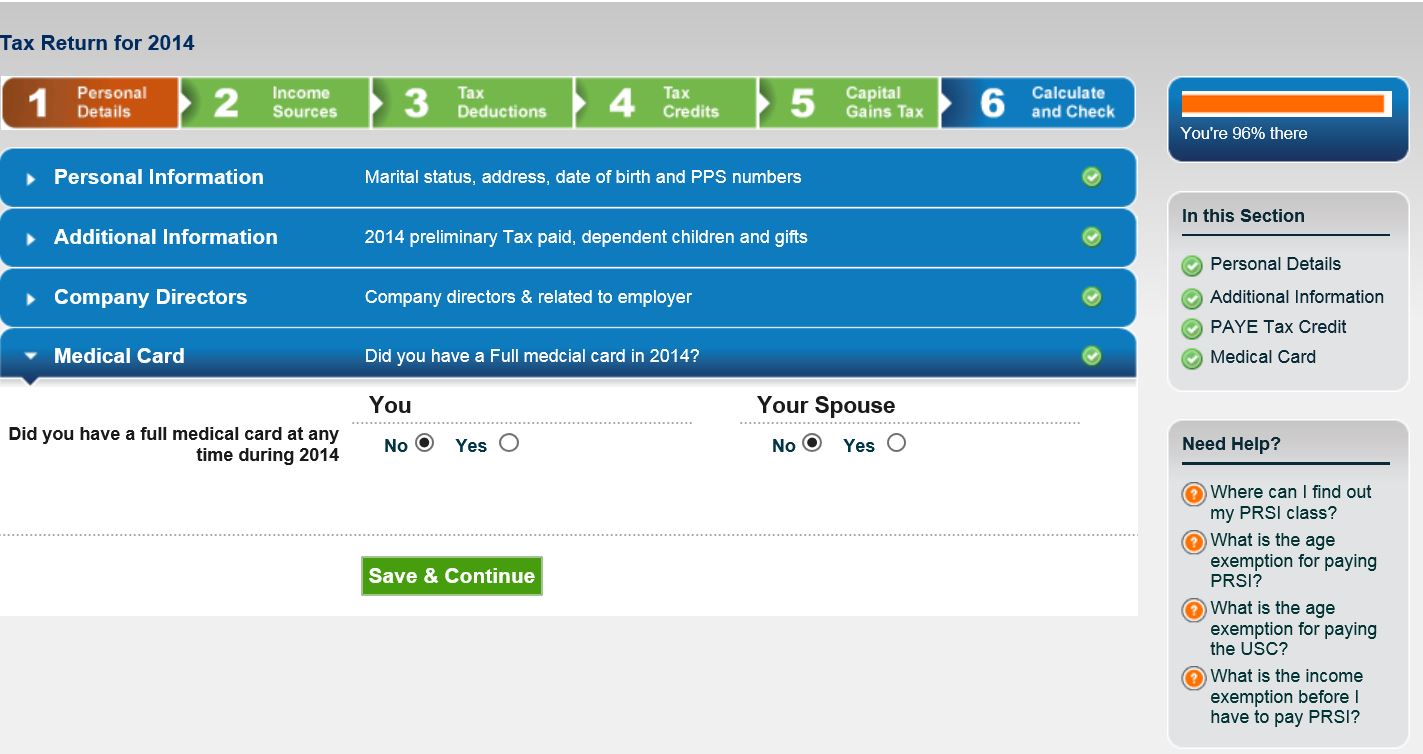

Paylesstax 6 Easy Steps Paylesstax

Paylesstax 45 Minute Tax Return

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

Paylesstax 6 Easy Steps Paylesstax

Restricted Stock Units Jane Financial

Paylesstax 6 Easy Steps Paylesstax

Discover Your Potential Recruitment Startup Company Funding Options Visit Http Wearessg Com Setting Up A Recruitment Business

.png?width=1952&height=840&name=Add%20a%20subheading%20(2).png)

Tax On Share Options In Ireland How Stock Options Are Taxed In Ireland

Paylesstax 45 Minute Tax Return

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com